Rework the Reform

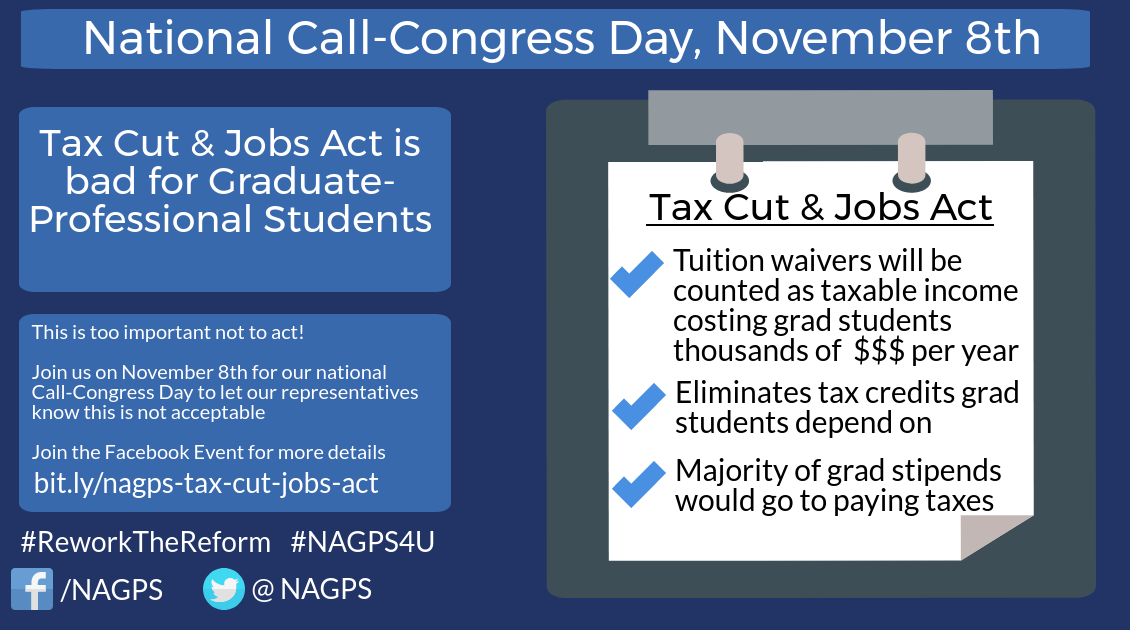

The Tax Cuts and Jobs Act proposed by Congress will have a significant impact on institutions of higher education and graduate-professional students. The provision under the bill, Sec. 1204 proposes to repeal the Interest Payment on Qualified Education Loans, Tuition & Related Expenses, Interest on United States Savings Bond, Qualified Tuition Reduction, and Employer-Provided Education Assistance. An amendment was proposed strike Sec. 1204 from the bill, and expand American Opportunity Tax Credit. Unfortunately, the amendment was voted down along party lines.

House Vote Resources November 16th

The House f Representatives will vote today on the Tax Cut and Jobs Act. Use the resources below to contact your reps. Call. Tweet. Share.

Act Now: Contact These Members of Congress

What Can you Do?

There is still much work to be done! Stay involved with the fight as this will likely be a long one. We need your voice for this campaign to be successful so help the National Association of Graduate and Professional Students in our efforts to support graduate-professional students across the nation who will be impacted by the provisions of this bill. Here is what you can do help us be effective for you.

- Go to the #ReworkTheReform Press Kit to keep up to date on news on the proposed reform and for materials to share on social media

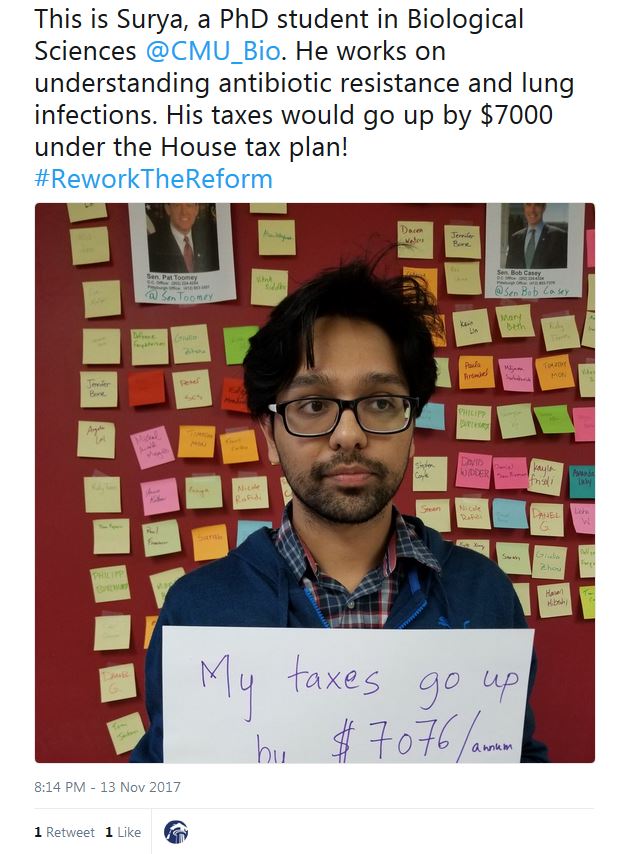

- Share your stories on social media, Twitter and Facebook, about how you will be affected. Click on the photo on the right to see more examples on Twitter

- Write your Representative in Congress. Download Template Letter

- Write your State Representative . Download Template Letter

- Write Your University Administrators. Download Template Letter

NAGPS Statements on the Tax Cut and Jobs Act

Press Coverage

NAGPS has been the dominant voice for graduate-professional students on this issue and the press has sought our opinion throughout. Here are links to press coverage including NAGPS mentions on this issue.

- Inside Higher Ed in Senate Tax Bill – Inside Higher Ed

- Some UMD graduate students worry tax reform will increase their debt

- Why the Republican tax plan could make graduate students drop out – Marketwatch

- Grad Students Are Freaking Out About the GOP Tax Plan. They Should Be – Wired.com

- Graduate Student Senate: Members to discuss new GOP tax plan – The Post Athens

- Taxing a Coupon – Inside Higher Ed

- What the GOP’s tax reform bill means for graduate student education – The Post Athens

How the Tax Cut & Jobs Act Affects You